Many bad credit events are gotten rid of from your credit file after seven years thanks to the Fair Credit Reporting Act, however there are some specifications. Check out more about the Fair Credit Reporting Act on ftc. gov here. Some owners believe the repercussions are less serious if they've paid off their timeshare.

It makes no distinction if you're still paying on the timeshare or if you have actually currently paid it off. You're still obligated to pay the maintenance charges. Depending on the resort, you won't be able sell or rent your timeshare up until the upkeep charges are paid off. This is without a doubt the worst consequence of not paying your upkeep cost because SellaTimeshare.

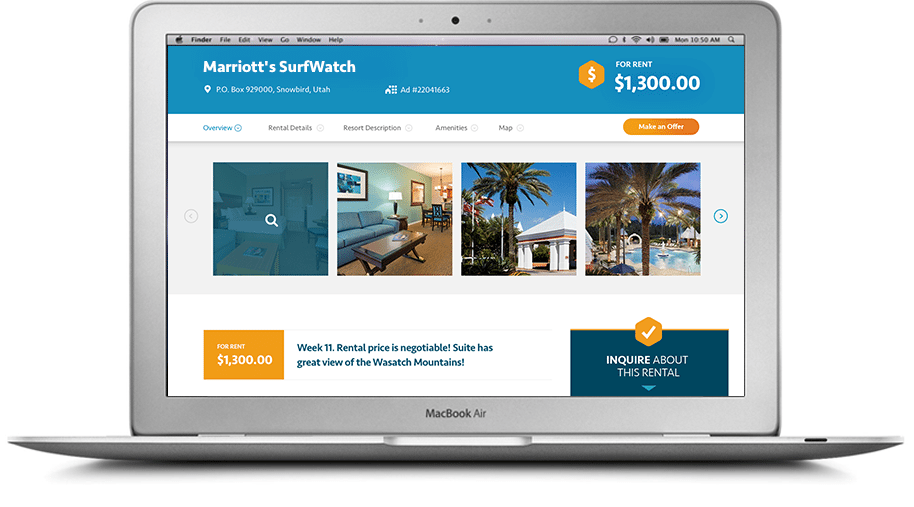

For only $14. 95 per month you can promote your timeshare to countless visitors per year. Cancel at any time. Prepared to get begun? Start your complimentary trial today!.

Have you asked yourself the concern, "What Occurs if I Default on Timeshare Payments?" Some individuals are curious to understand what effects they will face if they default on their timeshare dedication. Likewise, there are major repercussions if you do not pay your payments as promised. Regardless of the circumstance that causes a timeshare member to think about not paying, it is wise to make a clever decision.

To remain safe and make sensible monetary decisions, checked out the short article below. It shares crucial details about what timeshare owners can anticipate if they default on timeshare payments. To start with, it is very important to recognize that timeshare ownership legally binds you to make regular payments. In spite of the reasons that timeshare marriot occur that may trigger an owner to have difficulty paying, it is best to remain on top of payments as promised.

For example, your credit history will be adversely affected if you stop paying. That could cause you to have trouble obtaining loans or mortgages in the future. Plus, legal action might be taken versus you if you stop paying. There is likely a way to organize your financial resources and return on track before you default.

Maintenance fees are likewise required to be paid. If they are not paid, you will be thought about as defaulting on your timeshare responsibilities. Remember, maintenance costs need to be as much as date in order to utilize your timeshare unit. Once a member stops paying their timeshare maintenance fees, they lose rights to utilize the timeshare unit.

Not known Incorrect Statements About How Timeshare Works

Much https://postheaven.net/margarhva1/the-two-principal-exchange-business-are-resort-condominiums-international-rci more risky is that your existing company can sell your financial obligation to a debt collection agency if they think you have no intention to pay your dues. In addition to fees from your supplier, even foreclosure is possible if you just stop paying your timeshare payments - what is timeshare property. To begin with, your existing service provider will usually send you a written warning if you don't make your required payments.

Even your ownerships could have a claim submitted versus them. Last but not least, if you took out a loan or paid your timeshare membership with a credit card, you are still lawfully required to pay payments as well as any late fees or interests that accumulates, too. Credit history are extremely important.

If you default on your timeshare payments, your timeshare debt will be offered to a debt collector. Keep in mind, your credit rating is always examined when you buy any large products on credit. You will likely be denied a loan if you have a bad score since you did not stay present with your timeshare payments.

Nobody wishes to face public humiliation if a collector pertains to visit you in your home or work. Lastly, some timeshare owners have ended up being victims of timeshare cancellation rip-offs. However, no one can cancel a timeshare contract after the rescission duration has passed which is just a couple of days or weeks after the membership construct is signed.

Never ever involve any 3rd party business that could be scammers. There are numerous severe effects to think about if you are asking yourself the question, "What occurs if I default on timeshare payments?" We hope this short article assisted reveal you the value of remaining current on your fees so you can delight in amazing holidays that your family is worthy of.

The short response is "yes." When you take out a mortgage loan for a timeshare purchase, you sign an arrangement to make monthly payments on The original source the timeshare up until the debt is entirely paid off (usually for a period of 10 or 15 years). Simply like any other home mortgage payment, it's very important to maintain your payment schedule on your timeshare and not to fall back on any timeshare mortgage payments and evaluations.

In addition, even if you have actually settled your timeshare loan, but for one reason or another stop paying your upkeep costs and other associated costs, you are likely to deal with foreclosure on your timeshare as well. In fact, not paying maintenance charges on your timeshare is essentially dealt with the exact same method as not paying on your timeshare home mortgage - how much is a timeshare worth.

The 7-Minute Rule for How To Get Out Of My Timeshare

What is the timeshare foreclosure procedure? Foreclosure is a legal process that includes the timeshare business litigating for breach of agreement to get a lien on your timeshare if you ought to default in the payment of your timeshare loan, in addition to any other costs, costs and assessments connected with the particular timeshare in concern.

For example, in 2010 Florida passed a timeshare foreclosure law that reduced the quantity of time needed to process a timeshare foreclosure from 18 months to simply 90 days. Nevertheless, in other states, the foreclosure process might still use up to a year or more. Note that state law often lays out the requirements for how and when timeshare liens can be foreclosed.

( In order to learn more about your state's particular laws governing timeshare foreclosures, require time to research study and review the state's statutes.) Understand that a timeshare foreclosure, comparable to a residential foreclosure, could cause serious unfavorable monetary effects. In truth, a timeshare foreclosure enters into your credit report and can have a significant effect on your monetary situation for several years to come.

A timeshare foreclosure appears on your credit report for 7 years in addition to any entries about previous collection efforts relating to the timeshare. A timeshare foreclosure might also have a for approximately seven years in lots of (but not all) cases. A timeshare foreclosure might lead to than dominating market rates on credit cards or vehicle loan, as well as to the such as personal loans, lines of credit and other kinds of loans.

A timeshare foreclosure considering that the Irs (Internal Revenue Service) requires forgiven debt to be incorporated into your gross income unless you take place to certify for an exception or exemption. Cancellation of Debt income is reported to the Internal Revenue Service on your yearly income taxes through a 1099-C tax kind. Make certain that you research and comprehend the tax implications of a timeshare foreclosure and how a foreclosure might possibly affect your annual income taxes.